Every employee who is contributing to employee provident fund scheme can take advance from their EPF amount, but to get EPF loan they must fulfill some eligibility criteria.

Any EPF member can avail PF loan facility if they full fill the eligibility criteria and there is no need to return the availed PF advance because it is your amount. Here are PF advance withdrawal rules and EPF loan eligibility calculator.

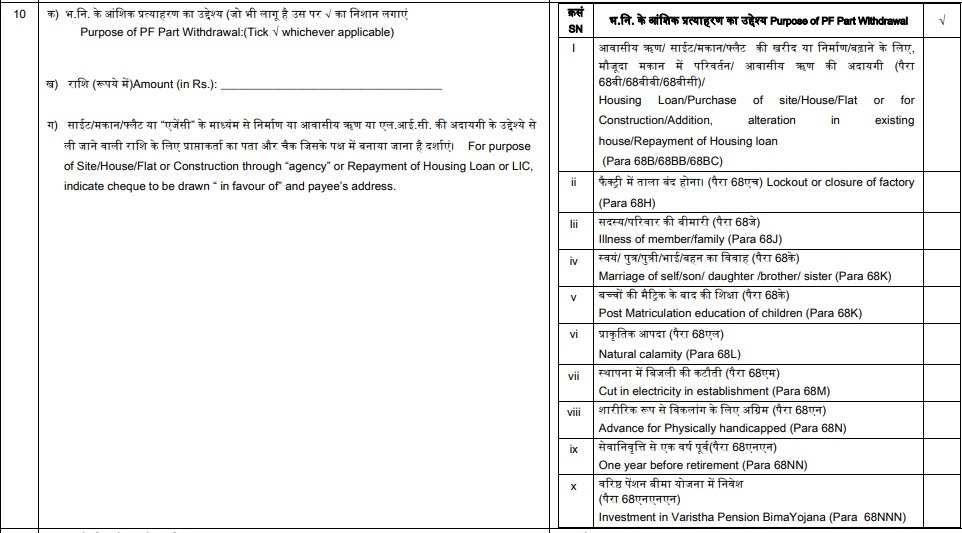

There are Two ways to withdraw PF advance amount, one is through the online method and another one is the offline method. In both online and offline methods employees need to submit PF claim form 31. Now PF claim form 31 was replaced by EPF composite claim form Aadhar and non-aadhar.

Note: Apply for PF loan only when you fulfill the above eligibility criteria, otherwise your claim will get rejected.

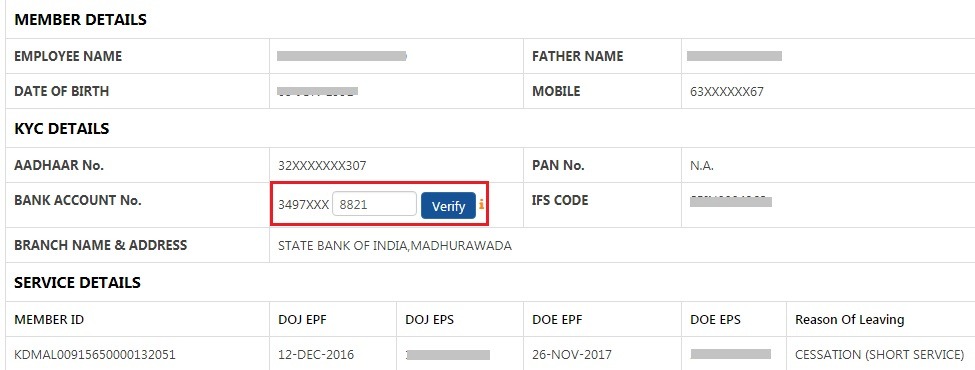

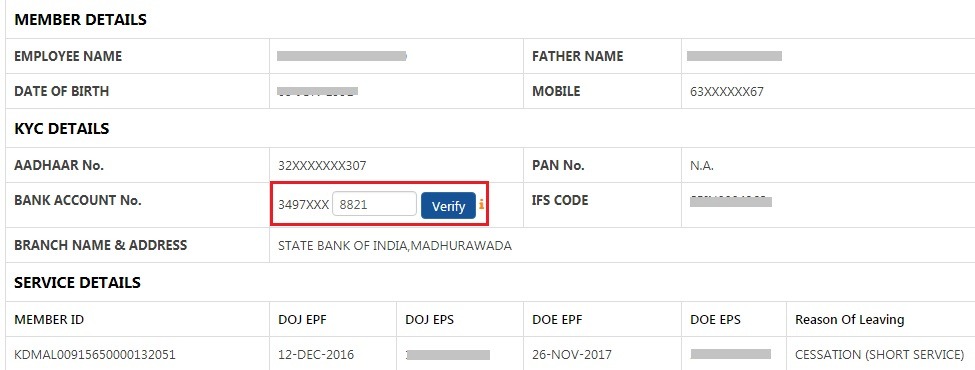

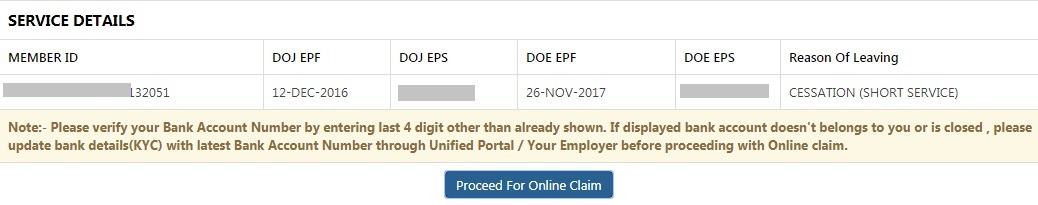

When compared with offline PF advance withdrawal processing time online PF advance withdrawal process time is less. But in major cases, PF advance claims are getting settle in between 15 – 20 days. If you are lucky then you might get your PF loan amount within 10 days also. As I said earlier if you want to get your PF advance amount soon it is better to go for the online claim, but for that, your KYC has to be linked with your UAN number.